A modern and productive approach to managing transactions is essential in currently’s enterprise atmosphere. Payment orchestration has emerged as an important Resource for enterprises planning to improve their financial procedures. The position of Highly developed platforms in facilitating seamless payment integration for both equally B2B and B2C enterprises is becoming significantly prominent, showcasing a broad spectrum of comprehensive methods intended to deal with different industry requires.

A strong infrastructure is essential for companies to deal with and route payments properly. This infrastructure supports enterprises in sustaining operational performance although maximizing client gratification. By supplying a big range of payment answers, platforms During this Room empower providers to streamline their workflows and target offering remarkable providers for their clientele. Regardless of whether it requires on line transactions, recurring billing, or multi-forex processing, organizations can considerably reap the benefits of adopting functional and scalable payment units.

Among the essential options of those programs is the opportunity to tackle cross-border transactions effortlessly. Companies operating on a global scale involve options that will adapt on the complexities of Global commerce. From controlling currency conversions to ensuring compliance with regional laws, this sort of platforms Perform a pivotal part in preserving the integrity of transactions although decreasing operational bottlenecks.

Within the context of businesses serving both of those B2B and B2C marketplaces, payment orchestration serves being a bridge among the two products. These platforms allow for businesses to cater to a diverse range of customers while protecting overall flexibility within their payment procedures. Irrespective of whether a firm is working with significant-scale enterprises or specific customers, it can trust in an adaptable framework that accommodates varying transaction dimensions and prerequisites.

Thorough payment systems are Outfitted to assistance many payment strategies, together with charge cards, electronic wallets, bank transfers, and different payment choices. This wide range ensures that shoppers can select their chosen payment method, thereby boosting their overall knowledge. A chance to integrate with current systems and offer you serious-time information insights even more provides to the worth provided by these answers.

Protection remains a best priority for firms in currently’s electronic age. Platforms giving Superior payment capabilities spot important emphasis on defending delicate money information and facts. With features for instance tokenization, encryption, and fraud detection instruments, they ensure that transactions are carried out in a protected and trusted method. These safeguards are very important for protecting the confidence of shoppers and partners alike, fostering very long-time period business enterprise interactions.

Adaptability and scalability are significant factors for businesses aiming to stay aggressive in a very dynamic Market. Payment orchestration platforms offer you the agility needed to adapt to altering buyer requires and technological improvements. By offering organizations While using the instruments to handle fluctuating transaction volumes and accommodate expansion, these techniques enable businesses to accomplish sustained results.

In addition, enterprises reap the benefits of the centralization of payment administration. By consolidating payment procedures in just a unified platform, corporations can simplify their operations and cut down the administrative load associated with dealing with various payment assistance providers. This centralization not merely increases effectiveness but will also allows for simpler cost management.

Details analytics and reporting are further pros provided by detailed payment answers. These platforms provide corporations with valuable insights into transaction tendencies, shopper conduct, and money functionality. By leveraging this facts, organizations could make knowledgeable conclusions and apply methods that drive development and profitability.

A crucial factor of contemporary payment units is their capability to combine with several third-bash applications. This interoperability boosts the performance from the platform, allowing businesses to customise their payment workflows to go well with their distinct demands. Regardless of whether it requires integrating with e-commerce platforms, ERP techniques, or accounting software program, the pliability of those options makes sure seamless Procedure across distinctive organization functions.

For businesses centered on optimizing their payment procedures, the adoption of Innovative technologies for example device Studying and synthetic intelligence has become progressively common. These technologies help platforms to discover patterns, predict shopper Choices, and detect likely fraud in authentic time. By incorporating clever equipment into their payment strategies, companies can enhance their operational effectiveness and safeguard their money transactions.

The global character of recent commerce calls for options which will navigate the complexities of Worldwide markets. Payment orchestration platforms tackle this will need by offering multi-forex aid, localized payment solutions, and compliance with assorted regulatory requirements. These options help businesses to expand their reach and build a existence in new markets with self-confidence.

Buyer experience plays a central position during the achievement of any enterprise. By supplying a seamless and successful payment system, corporations can greatly enhance shopper gratification and loyalty. A chance to give a frictionless payment journey, from checkout to affirmation, is usually a significant Think about developing a favourable standing and attracting repeat business enterprise.

Among the problems faced by companies is managing disputes and chargebacks. Payment orchestration platforms simplify this method by offering equipment to track, regulate, and solve disputes efficiently. bluesnap By lowering the administrative stress connected to chargeback management, these solutions empower enterprises to concentration on their Main pursuits and boost their overall performance.

As well as their operational Advantages, advanced payment programs contribute to a business’s money well being by lessening transaction charges and optimizing payment routing. These Expense savings are significantly substantial for businesses managing a high quantity of transactions, as they are able to Use a immediate influence on profitability.

Yet another benefit of these platforms is their power to assistance membership-primarily based company models. With characteristics which include automatic billing, recurring payments, and membership management, they allow businesses to cater to clients preferring versatile payment arrangements. This functionality is especially precious in industries such as application-as-a-support, media streaming, and e-commerce.

Businesses seeking to scale their functions need alternatives that will increase with them. Payment orchestration platforms offer the scalability required to handle growing transaction volumes and accommodate expanding products or services lines. By offering a trustworthy and adaptable infrastructure, these methods help enterprises to attain their growth objectives with out compromising on effectiveness.

Collaboration concerning corporations as well as their payment company vendors is essential for good results. By partnering with platforms that provide a comprehensive suite of providers, corporations can leverage abilities and sources to optimize their payment strategies. This collaboration not just boosts the caliber of services sent to prospects but also strengthens the Firm’s competitive position out there.

The opportunity to customise payment workflows is often a crucial feature of contemporary platforms. Businesses can tailor their payment processes to align with their unique operational demands and shopper preferences. This customization improves the overall effectiveness of your payment program and makes certain a far more individualized expertise for close-users.

Regulatory compliance is another critical thing to consider for organizations functioning in various marketplaces. Payment orchestration platforms simplify compliance by furnishing tools and resources to navigate elaborate regulatory landscapes. By making sure adherence to authorized and business specifications, these solutions guard businesses from probable dangers and liabilities.

The combination of cell payment selections is actually a expanding development in the marketplace. As far more shoppers depend on cellular gadgets for their transactions, enterprises will have to adapt to satisfy this desire. Platforms that help cellular payments help corporations to offer a practical and consumer-welcoming encounter for his or her consumers, thus improving engagement and satisfaction.

Innovation can be a driving force inside the evolution of payment programs. By staying in the forefront of technological advancements, organizations can maintain a aggressive edge and deliver outstanding benefit to their customers. Payment orchestration platforms play a central part in facilitating this innovation, enabling organizations to experiment with new technologies and implement reducing-edge options.

The value of transparency in payment procedures cannot be overstated. Enterprises and buyers alike benefit from crystal clear and exact transaction data. Comprehensive payment answers deliver in depth reporting and tracking capabilities, guaranteeing that each one functions have usage of the data they have to make educated selections.

Sustainability is an rising thing to consider for businesses within the payments business. By adopting eco-helpful techniques and cutting down their carbon footprint, businesses can show their commitment to environmental responsibility. Payment platforms that prioritize sustainability add to these initiatives by optimizing transaction procedures and minimizing squander.

In summary, the adoption of modern payment devices gives numerous Added benefits for organizations of all measurements and industries. By leveraging State-of-the-art technologies, extensive answers, and a global standpoint, businesses can streamline their operations, improve purchaser fulfillment, and achieve sustainable progress in a competitive marketplace. The integration of these platforms into existing organization procedures is actually a strategic financial investment that provides long-phrase benefit and positions enterprises for success from the electronic economic climate.

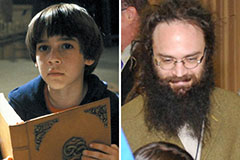

Barret Oliver Then & Now!

Barret Oliver Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!